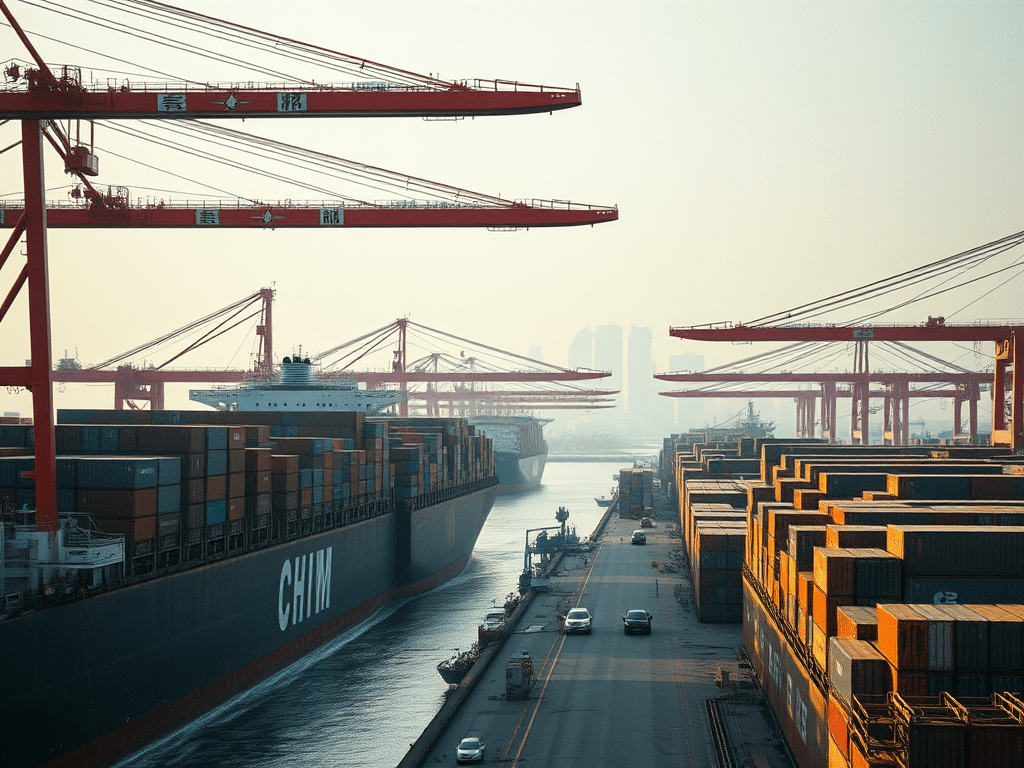

China’s trade figures for October showcased a mixed picture. Exports saw their most significant increase in months. Nonetheless, imports declined more than anticipated. Despite ongoing economic challenges, China’s trade sector continues to play a crucial role in supporting the nation’s economy.

Key Highlights

1. Export Growth Exceeds Expectations

China’s export performance in October was notably strong, marking a sharp contrast to subdued forecasts. Exports grew by 12.7% year on year, reaching $309.06 billion. This growth shows the highest increase since March 2023 and far exceeded analysts’ predictions of 5.2%. The robust export numbers were driven by several factors:

- Delayed shipments resulting from improved weather conditions.

- Discounted pricing strategies to keep market share.

- Increased demand ahead of the Christmas season.

2. Imports Face Steeper Decline

On the other hand, China’s imports fell by 2.3% in October, a more significant decline than the expected 1.5% drop. This follows a modest import growth of 0.3% in September, indicating ongoing challenges in domestic demand and economic conditions.

3. Impact of Market Conditions and Economic Challenges

The favorable export figures helped balance some of China’s broader economic difficulties, including:

- Weakening domestic consumption, impacting overall economic strength.

- A prolonged property crisis weighing heavily on financial stability.

- The importance of export growth as a key driver amid these challenges.

Trade Relations and Regional Growth

4. Trade Relations and Key Markets

China’s export relationships with key regions saw mixed but promising trends:

- Exports to the U.S. grew by 8.1%, while imports from the U.S. increased by 6.6%.

- Exports to the European Union rose by 12.7%, and to the Association of Southeast Asian Nations (ASEAN) by 15.8%.

- Trade with Russia stood out, with exports surging nearly 27%.

5. Future Outlook and Challenges

Looking ahead, analysts stay cautiously optimistic. The strong export momentum will continue into next year as businesses aim to pre-empt potential trade disruptions. Nonetheless, concerns over rising global protectionism and calls for stronger domestic stimulus to boost internal demand persist.

Factory Activity Shows Recovery

October’s trade performance coincided with signs of improvement in China’s manufacturing sector. The official purchasing managers’ index (PMI) reached 50.1, signaling expansion for the first time since April. This recovery hints at a possible stabilization of factory activity, which is crucial for sustaining export growth.

Summary of Key Trade Data

| Category | Details |

|---|---|

| Export Growth | 12.7% year on year, $309.06 billion (Highest since March 2023) |

| Analyst Estimates | Expected 5.2% growth (Actual: 12.7%) |

| Import Decline | Fell 2.3% (Expected: 1.5% decline) |

| September Imports | Grew by 0.3% |

| Exports to U.S. | Increased by 8.1% |

| Imports from U.S. | Rose by 6.6% |

| Exports to EU | Increased by 12.7% |

| Exports to ASEAN | Increased by 15.8% |

| Exports to Russia | Surged nearly 27% |

| PMI (October) | 50.1 (First expansion since April) |

These insights underline the significance of export performance as a stabilizing factor for China’s economy amid uncertainties. The coming months will be critical for determining whether export strength can sustain momentum and help offset domestic economic concerns.

Leave a comment