The garment industry, long a cornerstone of Bangladesh’s economy, faces an alarming crisis in 2024. With factory closures, job losses, and economic uncertainty, the situation highlights vulnerabilities in the country’s reliance on this vital sector. As challenges mount, international markets and buyers are increasingly looking toward India as a viable alternative for garment manufacturing.

The Crisis in Bangladesh’s Garment Industry

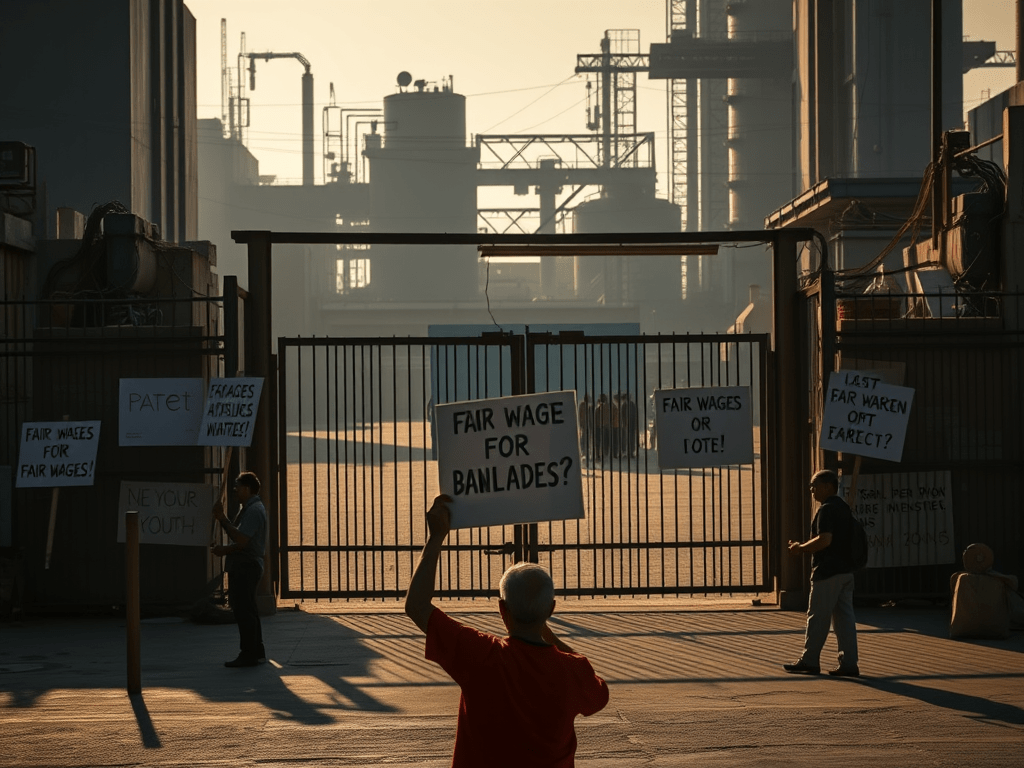

- Factory Closures and Worker Protests

Four apparel factories under the Keya Group in Gazipur, part of Dhaka’s garment district, are set to close permanently on May 1, 2024, marking a grim International Workers’ Day. The closures will affect thousands of workers, many of whom have been protesting unpaid wages since December 2023. - Economic Pressures

The closures are a symptom of deeper economic woes. Bangladesh’s GDP growth target has been adjusted downward to 6.7%, reflecting a decline in global demand and rising unemployment. These economic struggles are exacerbated by labor unrest and mounting social tensions. - Political and Social Instability

Bangladesh’s challenges are not confined to economics. Political instability and reduced stock market performance have added to the uncertainty. International assistance has been sought to address issues like money laundering, signaling the gravity of the situation.

| Key Economic Indicators | 2023 | 2024 (Projected) |

|---|---|---|

| GDP Growth Target | 7.2% | 6.7% |

| Factory Closures | 0 | 4 (Keya Group) |

| Workers Affected (Garment Sector) | N/A | Thousands |

India: The Emerging Alternative

As Bangladesh’s garment industry grapples with these challenges, India is increasingly being seen as a promising alternative for global garment manufacturing.

- Strategic Advantages

- Diverse Production Base: India offers a wide range of garment production, from cotton to technical textiles, catering to varied global demands.

- Skilled Workforce: The country’s large, skilled labor force is a significant draw for international buyers.

- Government Support: Initiatives such as the Production-Linked Incentive (PLI) scheme for textiles and apparel encourage investment and boost manufacturing capacity.

- Geopolitical Stability

Unlike Bangladesh, India enjoys relative political stability, instilling confidence in international buyers seeking uninterrupted supply chains. - Sustainability Initiatives

With growing demand for sustainable and ethical manufacturing, India’s focus on eco-friendly production processes aligns well with global consumer preferences.

| India vs. Bangladesh: Garment Industry | India | Bangladesh |

|---|---|---|

| Workforce Size | Large and Skilled | Large but Facing Unrest |

| GDP Growth (2024) | ~6.9% (Projected) | 6.7% (Projected) |

| Sustainability Initiatives | Strong | Limited |

| Political Stability | High | Low |

Opportunities for Global Buyers

The crisis in Bangladesh is pushing international brands to reassess their sourcing strategies. India stands out as a potential alternative due to:

- Proximity to Key Markets: India’s location offers logistical advantages for exports to Europe, the Middle East, and Africa.

- Growing Infrastructure: Ports, roads, and rail networks in India are rapidly modernizing, supporting efficient supply chains.

- Competitive Costs: While slightly higher than Bangladesh, India’s production costs are offset by better reliability and value-added services.

Challenges and Way Forward for India

To fully capitalize on this opportunity, India must address certain challenges:

- Labor Reforms: Simplifying labor laws will ensure smoother operations for manufacturers.

- Ease of Doing Business: Continued improvements in regulatory frameworks will attract more foreign investment.

- Sustainability Standards: Strengthening eco-friendly practices and certifications will boost India’s global competitiveness.

Conclusion

The turmoil in Bangladesh’s garment industry is a wake-up call for global buyers and manufacturers. While the challenges are significant, they also present an opportunity for India to establish itself as a preferred destination for garment manufacturing. With strategic investments, government support, and a focus on sustainability, India can not only absorb the displaced demand but also set new benchmarks in the global apparel industry.

The transition will require a concerted effort from policymakers, manufacturers, and industry stakeholders, but the potential rewards are immense—both for India and the global garment market.

Leave a comment