Despite political promises to restore American auto manufacturing jobs, the true forces reshaping the U.S. auto industry are far more complex than trade tariffs alone. While recent administrations, particularly Donald Trump’s, have focused on tariff-based strategies to bring jobs back home, automation, global market dynamics, and shifting manufacturing footprints have played a far more significant role in transforming the sector.

Tariffs vs. Technology: A Mismatch in Expectations

Tariffs on imported vehicles and parts were intended to revive the American auto job market. However, experts argue that these trade measures fail to address the dominant issue: automation.

Key Job-Shaping Factors in the U.S. Auto Industry

| Factor | Impact |

|---|---|

| Tariffs (Trade Policy) | Attempted to curb imports and encourage local production |

| Automation | Reduced labor hours from 50 (1988) to ~20 (2005), cutting jobs drastically |

| Global Competition | Foreign brands gained market share, challenging domestic automakers |

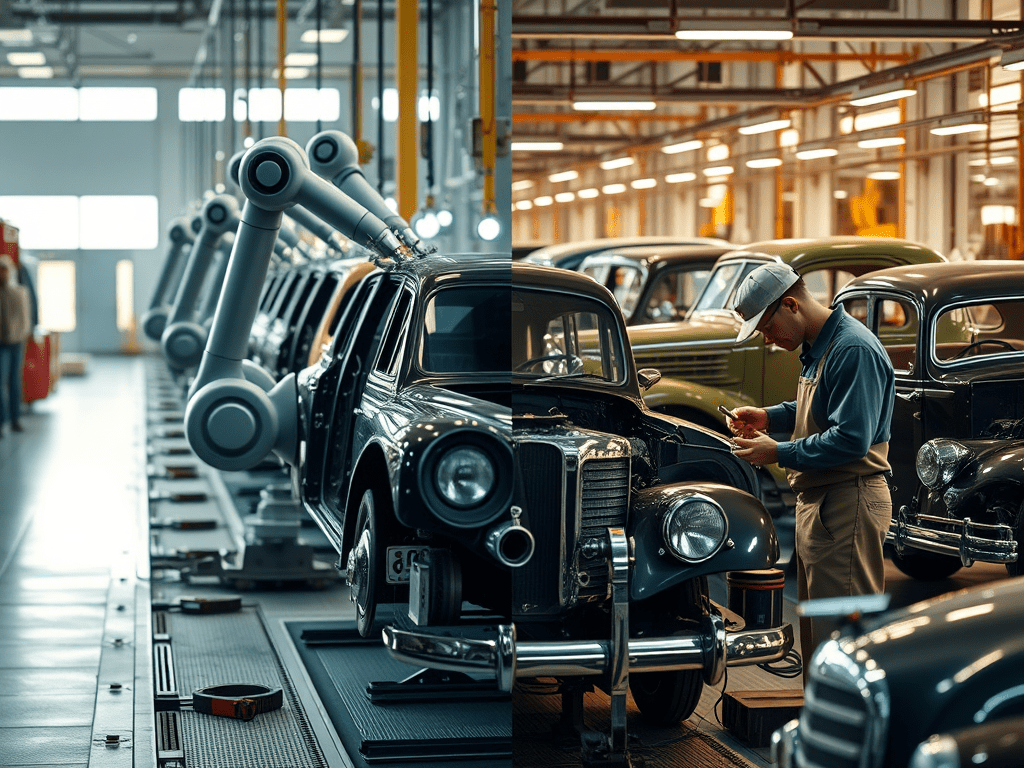

Automation: The Quiet Job Killer

The mechanization of auto production has been ongoing for decades. From robotic arms on the factory floor to advanced AI-driven logistics, automation has cut job demand significantly, even as production levels have rebounded.

“Today, it takes less than half the time to build a car compared to the late ’80s,” notes one industry expert. “This efficiency gain is great for output, but not for employment.”

The Fall of the Big Three

Once dominant players, General Motors, Ford, and Chrysler have seen their combined market share plummet from over 80% in the 1970s to just 38% in 2024.

U.S. Auto Market Share Over Time

| Year | Big Three Market Share |

|---|---|

| 1970s | Over 80% |

| 2000 | ~55% |

| 2024 | ~38% |

Key contributors to this decline include:

- The rise of fuel-efficient, high-quality Japanese and Korean brands

- Quality control issues during the late 20th century

- Lagging innovation compared to global competitors

Geographic Job Shifts: From Detroit to the Deep South

While many parts of the Rust Belt have lost manufacturing jobs, southern states like Alabama, Tennessee, and South Carolina have become new auto hubs—thanks to right-to-work laws and incentives for foreign automakers.

Where the Jobs Are Going

| State | Trend |

|---|---|

| Michigan | Loss of parts jobs |

| Alabama | Growth in foreign-owned plants |

| Tennessee | Expansion of nonunion factories |

| Ohio & Illinois | Mixed results, slower growth |

Many of these newer plants are nonunionized, offering lower wages but also attracting foreign investment more readily.

Current State of U.S. Production

Despite job reductions in certain areas, U.S. auto production remains strong in terms of output.

Production and Purchase Snapshot

| Metric | Value (2024) |

|---|---|

| Cars Produced in U.S. | ~10.2 million units |

| Share of North American Output | 66% |

| Domestic Share of U.S. Car Purchases | 55% |

This shows a partial decoupling between employment and production—more cars are being made, but by fewer workers.

The Road Ahead: Can Jobs Rebound?

While the return of some parts manufacturing to the U.S. is likely—particularly due to geopolitical tensions and supply chain security concerns—experts caution that a full-scale job rebound is unlikely. Assembly roles may stabilize, but won’t return to pre-automation levels.

Future Outlook Summary

| Aspect | Prediction |

|---|---|

| Assembly Jobs | May grow modestly, but limited by automation |

| Parts Manufacturing | Possible onshoring, but limited job creation |

| Unionization | Continues to decline in southern states |

| Overall Job Recovery | Not expected to reach pre-1990 levels |

Conclusion: A New Auto Industry Landscape

The story of the U.S. auto industry is no longer just about trade policies or political promises. It’s about adapting to a technology-first world, where robots outwork humans, and global players compete for U.S. market share. Policymakers, labor unions, and manufacturers will need to collaborate on long-term strategies that account for this reality—one where automation, not imports, is the real disruptor.

Leave a comment