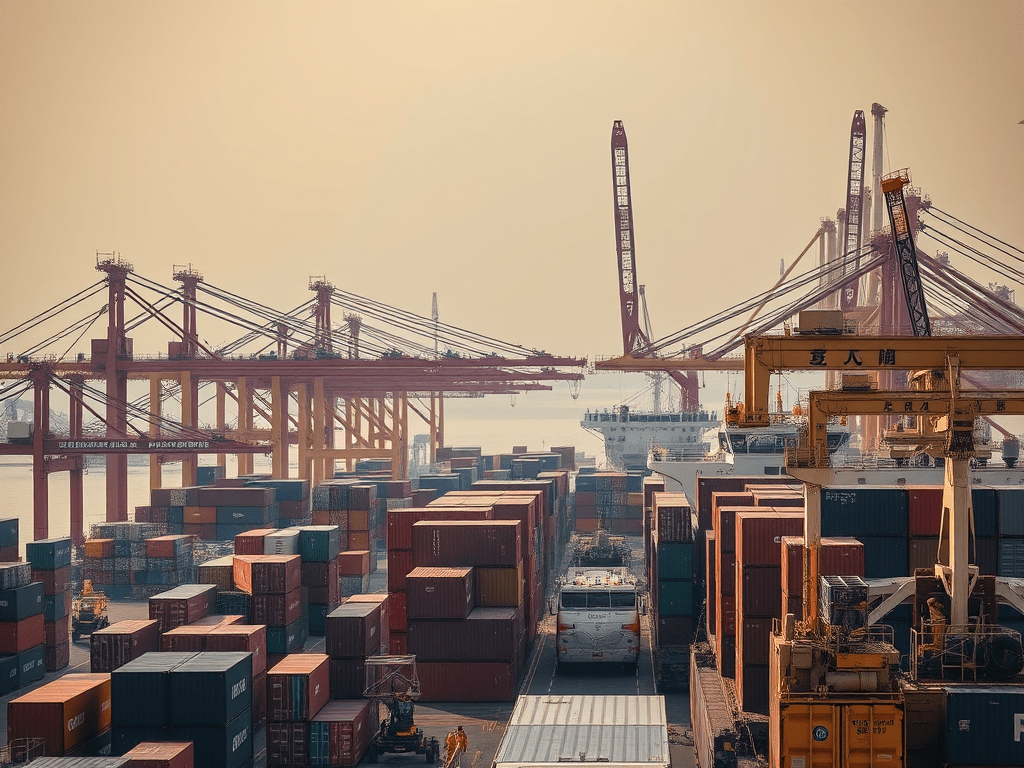

China’s port operations have seen a significant downturn in the week of April 7–13, 2025, reflecting mounting pressure from global trade tensions. The total cargo throughput dropped by 9.7%, amounting to 244 million tons, marking a sharp reversal from previous trends and raising concerns over the broader impact on China’s export-driven economy.

Tariffs Drive Down U.S.-Bound Exports

Analysts link the decline directly to the long-standing tariff measures imposed by the U.S. under former President Donald Trump’s administration, which continue to weigh heavily on Chinese export volumes. These trade policies have increasingly curtailed China’s outbound shipments to the U.S., disrupting supply chains and contributing to reduced port activity.

Container Throughput Also Dips

Alongside the overall cargo slump, container throughput fell by 6.1%, reversing a 1.9% gain observed in the previous week. The drop signals weakened demand for containerized trade, a critical component of China’s international shipping and manufacturing economy.

Worsening Weekly Trends

The 9.7% decrease during the current reporting period stands in stark contrast to the relatively modest 0.88% dip seen the week before, pointing to a deepening trend rather than an isolated event.

Key Trends: China’s Port Activity (April 7–13, 2025)

| Trend | Details |

|---|---|

| Overall Cargo Activity | Cargo handled fell by 9.7%, totaling 244 million tons. |

| Container Throughput | Dropped by 6.1%, reversing a 1.9% increase from the prior week. |

| Impact of Tariffs | Decline attributed to reduced exports to the U.S. due to U.S.-imposed tariffs. |

| Comparison to Previous Week | Current 9.7% drop vs. 0.88% decline last week, showing acceleration. |

Conclusion

The latest numbers are a stark reminder of the global ripple effects of geopolitical trade tensions. As the world’s largest exporter, China’s economic indicators—particularly those tied to port activity—are closely watched. The data from April 2025 signals caution, suggesting that without easing of trade restrictions, China’s maritime trade may face continued headwinds in the months ahead.

Leave a comment