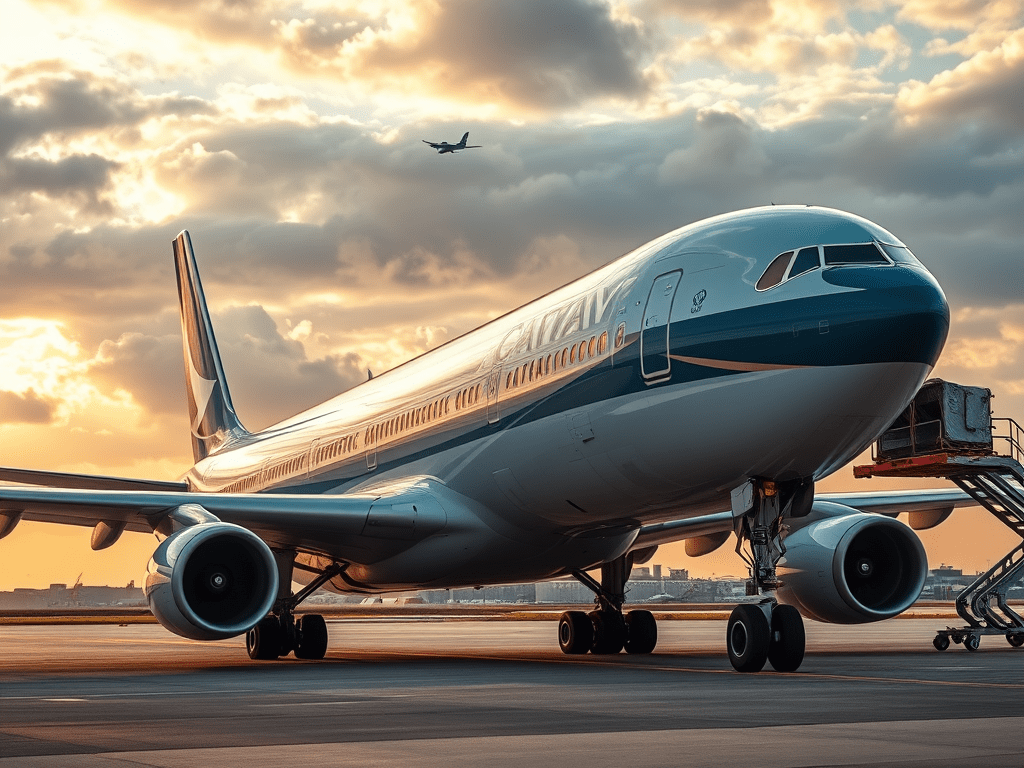

Cathay Pacific Airways, one of Asia’s major cargo carriers, is navigating turbulent skies as the global trade environment tightens. With rising U.S.-China tariffs and regulatory changes reshaping cross-border commerce, the airline anticipates a notable slowdown in air cargo demand—particularly on its key trans-Pacific routes.

Key Impacts on Cathay Pacific Air Cargo Operations

| Area of Concern | Details |

|---|---|

| Air Cargo Demand | Expected decline on China–U.S. routes due to tariff hikes and trade rules |

| Tariff Policy Change | U.S. ending de minimis exemption (< $800 value) from May 2 |

| Affected Sectors | E-commerce firms in China shipping low-cost goods to U.S. consumers |

| Operational Strategy | Freighters to be redeployed to alternate routes |

| Broader Economic Concerns | Impact on travel demand, higher supply chain strain, and rising costs |

Understanding the Challenges

1. Air Cargo Demand Decline

Cathay Pacific anticipates weaker demand for cargo services between mainland China and the U.S., which has traditionally been one of its most active routes. The airline attributes this trend to rising tariffs and trade restrictions, which are pushing shippers to reconsider air freight as a cost-effective option.

2. End of the De Minimis Rule

A major policy shift is the U.S. government’s decision to revoke the de minimis exemption on imports under $800, effective May 2. This rule had previously allowed Chinese e-commerce exporters to send goods into the U.S. without paying tariffs or undergoing extensive customs scrutiny. Its removal is likely to significantly affect small-package exports and direct-to-consumer logistics, which have boomed in recent years.

3. E-Commerce Sector at Risk

Online retailers and platforms such as Shein, Temu, and other marketplace sellers relying on low-value air parcels are expected to bear the brunt. This shift could lead to reduced volume for air cargo carriers like Cathay Pacific and signal a broader slowdown in cross-border e-commerce logistics.

4. Strategic Operational Adjustments

To counter the anticipated drop in trans-Pacific volumes, Cathay Pacific is reallocating freighter capacity to routes with higher yield or emerging demand. This tactical move is part of a larger effort to maximize aircraft utilization and maintain financial resilience amidst volatile market conditions.

5. Wider Economic and Operational Impact

Beyond cargo, Cathay Pacific highlighted potential ripple effects of trade policy changes on passenger travel, particularly business travel tied to U.S.-China commerce. The airline also warned of pressures on global supply chains and rising operational costs—from fuel to freight handling—as the trade environment becomes more restrictive.

Conclusion

Cathay Pacific’s proactive strategy to redeploy freighters and monitor market trends underscores the shifting terrain of international logistics. With policy shifts such as the elimination of the de minimis exemption reshaping the cost structures for air cargo, carriers will need to remain agile and innovative. As trade tensions continue to evolve, the airline industry—and particularly air freight operators—will face increasing complexity in balancing route economics, customer needs, and regulatory compliance.

Leave a comment