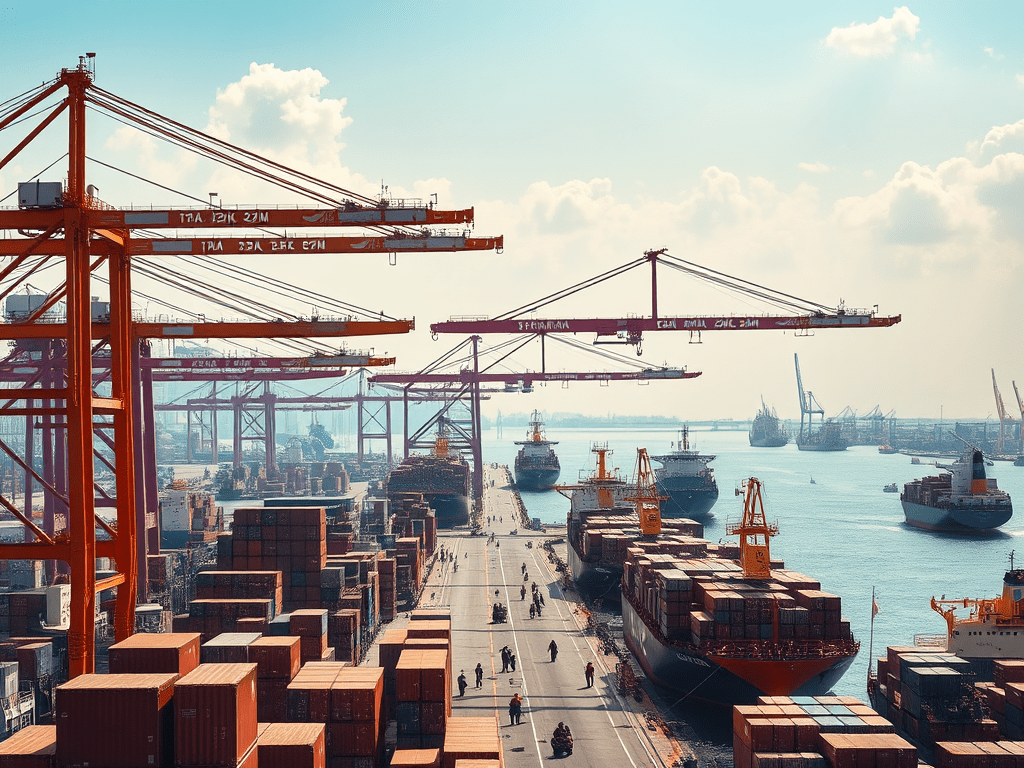

As global manufacturers reassess their supply chain strategies, the China+1 approach is gaining momentum, reshaping trade routes and benefiting emerging markets like India. This strategy, fueled by geopolitical tensions and the desire for supply chain diversification, is setting the stage for Indian ports to emerge as critical global trade hubs.

Understanding the China+1 Strategy

The China+1 strategy involves global companies reducing their dependence on China by establishing or expanding manufacturing and sourcing in other countries. India, with its vast domestic market, improving infrastructure, and geopolitical positioning, is among the top alternatives.

Moody’s Insights on Regional Impact

According to Moody’s Ratings, Chinese ports may face financial strain as global cargo volumes get redistributed. In contrast, Indian and Indonesian ports are likely to experience a surge in activity, reinforcing their role in the new global trade framework.

Key Advantages for Indian Ports

India is uniquely positioned to benefit from this shift. A stable domestic demand base, coupled with lower exposure to U.S. tariffs and a diversified export portfolio, offers Indian ports both resilience and growth potential.

Moody’s Economic Outlook for India

While Moody’s has revised India’s 2025 GDP growth forecast down to 6.3% (from 6.7%), the outlook remains strong with a forecasted rebound to 6.5% in 2026. This economic resilience supports sustained port activity and investment.

Key Impacts of China+1 on Indian Ports

| Impact Area | Details |

|---|---|

| Strategy Overview | China+1 is prompting global firms to diversify supply chains away from China |

| Geopolitical Drivers | Tensions in Asia and trade friction driving manufacturing relocations |

| Moody’s Forecast | Indian & Indonesian ports to benefit; Chinese ports may face headwinds |

| US Tariff Exposure | India’s lower tariff exposure makes it more competitive |

| Domestic Market Cargo Base | Most Indian port cargo supports internal demand, offering market stability |

| 2025 GDP Forecast (Moody’s) | Revised to 6.3% from 6.7% |

| 2026 GDP Forecast (Moody’s) | Projected to rise to 6.5% |

| Increased Cargo Activity | Anticipated surge due to alternative manufacturing setups |

| Port Infrastructure Investments | Expected rise in modernization and capacity-building |

| Regional Collaborations | Opportunities with other China+1 beneficiaries like Indonesia |

Strategic Implications for India’s Maritime Sector

The China+1 strategy doesn’t just mean more cargo—it demands better port readiness. Indian ports must ramp up infrastructure, technology, and logistics efficiency to capture the full potential of incoming global shifts. This includes investments in digitization, multi-modal connectivity, and green port initiatives to remain globally competitive.

Conclusion

The China+1 strategy represents a pivotal moment for India’s port ecosystem. With favorable macroeconomic fundamentals, a large domestic base, and improving infrastructure, Indian ports stand to gain not only in volume but in strategic global importance.

As companies recalibrate their global sourcing and manufacturing networks, Indian ports are no longer just regional gateways—they’re becoming central nodes in the global supply chain.

Leave a comment