In a high-stakes international development with geopolitical and commercial implications, China’s Cosco Shipping Corp., one of the world’s largest shipping conglomerates, is in advanced talks to join a $19 billion global ports acquisition. The consortium leading the deal includes Italian shipping magnate Gianluigi Aponte’s Terminal Investment Ltd. (TIL) and U.S. asset management giant BlackRock.

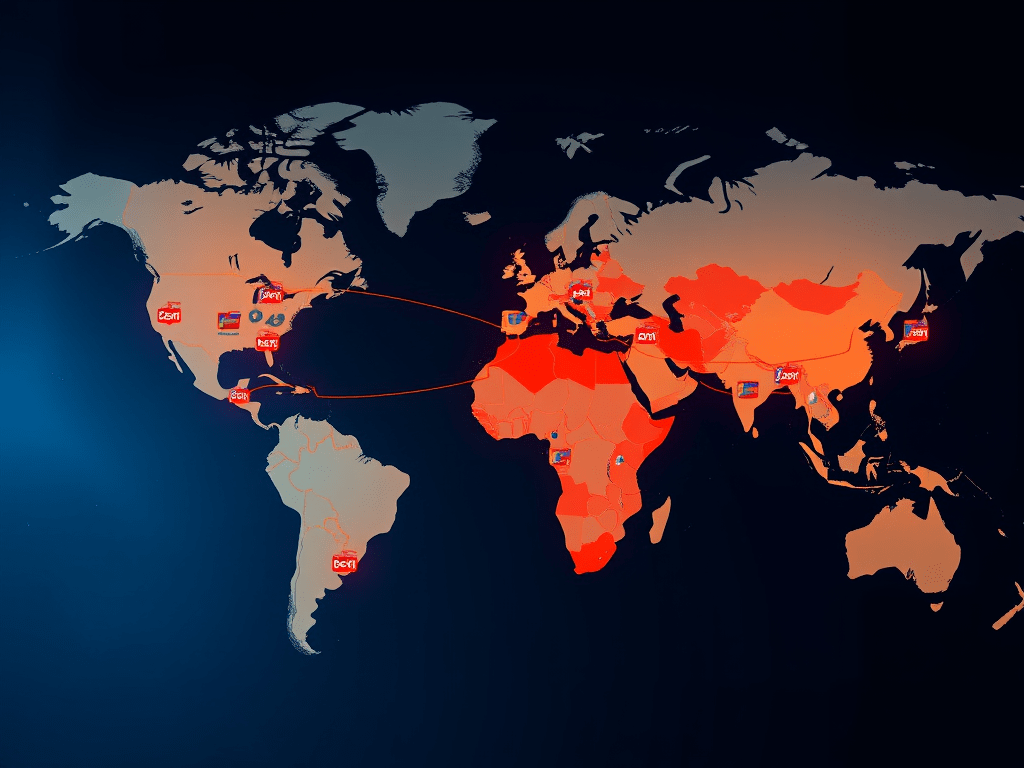

The acquisition spans 43 port terminals globally, including two critical locations along the Panama Canal, placing the deal at the intersection of trade strategy, maritime dominance, and national security considerations.

Background and Significance

The port assets are currently controlled by Hong Kong billionaire Li Ka-Shing. Originally framed as a strategic maneuver by the Trump administration to reduce Chinese influence in global logistics—particularly over sensitive routes such as the Panama Canal—the potential re-entry of Cosco Shipping into the bidding process has reignited concerns over trade influence and terminal consolidation.

Key Issues and Stakeholder Positions

| Key Element | Details |

|---|---|

| Deal Size | $19 billion |

| Assets Involved | 43 port terminals globally, including two near or along the Panama Canal |

| Lead Consortium | Terminal Investment Ltd. (TIL), owned by Gianluigi Aponte (Mediterranean Shipping Co.), and BlackRock |

| New Participant in Talks | Cosco Shipping Corp., China’s largest shipping company |

| Original Owner | Ports owned by Hong Kong billionaire Li Ka-Shing |

| Timeline | Missed initial agreement deadline in April; current talks are working toward a July-end deadline |

| Geopolitical Context | Deal arises amid renewed U.S.-China trade negotiations and discussions around tariffs |

| Concerns Raised | Panama Canal Authority fears loss of neutrality and competitiveness due to operational concentration under a single shipping entity |

| Official Responses | No public comment yet from Cosco, TIL, BlackRock, or the White House |

Panama Canal: Strategic Pressure Point

A major point of contention centers on the Panama Canal, a key maritime corridor facilitating global trade between the Atlantic and Pacific. The Panama Canal Authority has openly cautioned that this deal may tilt operational control toward a single entity, violating the canal’s principle of neutrality and potentially affecting global shipping competition and routing flexibility.

Conclusion: What’s at Stake?

Should Cosco Shipping join the consortium, the deal could reshape global port logistics, with far-reaching implications for shipping lines, freight forwarders, and geopolitical influence. The coming weeks will be critical as negotiations race against a July deadline, with major stakeholders watching closely to see whether commercial ambitions or political caution will ultimately define the outcome.

Leave a comment