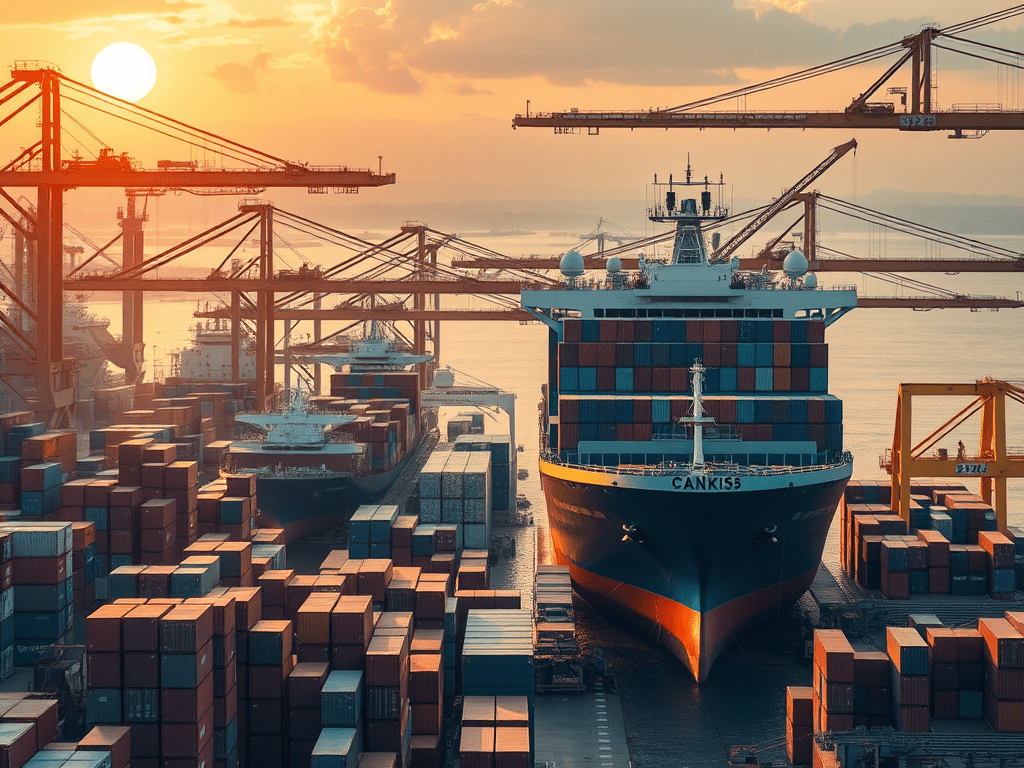

The global container shipping industry continues to grow as trade volumes rebound and supply chains evolve. In 2024, worldwide throughput touched 937 million TEUs, marking a 7% increase over the previous year. Growth is driven by stronger demand, technology adoption, and the rise of emerging players such as Vietnam, challenging long-established leaders.

Key Highlights

1. China Remains the Undisputed Leader

China maintained its dominance with 301.3 million TEUs, representing an 8% growth. Shanghai alone handled 51.5 million TEUs, making it the world’s busiest port, followed by Ningbo, Shenzhen, and Qingdao.

2. USA Maintains Strong Position

The USA handled 55.5 million TEUs, up 11%. Los Angeles and Long Beach remain critical gateways for trans-Pacific trade.

3. Southeast Asia and Emerging Players

Singapore handled 41.1 million TEUs, while Vietnam surged ahead with 23.4 million TEUs, recording the highest growth rate of 16%. Malaysia and the UAE also reported strong gains.

4. India’s Growing Presence

India reached 17.1 million TEUs, a healthy 11% increase, with Mundra and Nhava Sheva leading the charge.

Container Handling Volumes by Country

| Rank | Country | Total TEUs (Million) | Growth | Key Ports (TEUs in Million) |

|---|---|---|---|---|

| 1 | China | 301.3 | 8% | Shanghai (51.5), Ningbo (39.3), Shenzhen (33.4), Qingdao (30.9), Guangzhou (26.1) |

| 2 | USA | 55.5 | 11% | Los Angeles (10.3), Long Beach (9.6), New York (8.7), Savannah (5.5), Virginia (3.5) |

| 3 | Singapore | 41.1 | 5% | Transshipment hub |

| 4 | South Korea | 30.0 | 6% | Busan (24.4) |

| 5 | Malaysia | 29.4 | 9% | Port Kelang (14.6) |

| 6 | Vietnam | 23.4 | 16% | Ho Chi Minh (9.2), Cai Mep (7.1) |

| 7 | UAE | 21.0 | 10% | Dubai (15.5) |

| 8 | India | 17.1 | 11% | Mundra (8.0), Nhava Sheva (7.3) |

| 9 | Japan | 15.6 | 2% | Tokyo (4.7) |

| 10 | Spain | 15.4 | 10% | Valencia (5.5) |

Top Container Ports in the USA

| Port Name | TEU Volume (Million) |

|---|---|

| Los Angeles | 10.3 |

| Long Beach | 9.6 |

| New York | 8.7 |

| Savannah | 5.5 |

| Virginia Ports | 3.5 |

Outlook

The rise of Vietnam and India, coupled with robust performances from traditional giants, suggests a dynamic shift in global container traffic. Investments in port capacity, automation, and sustainability are critical as ports adapt to disruptions and larger vessels. With 937 million TEUs handled globally, the race for efficiency and market share is intensifying.

Leave a comment