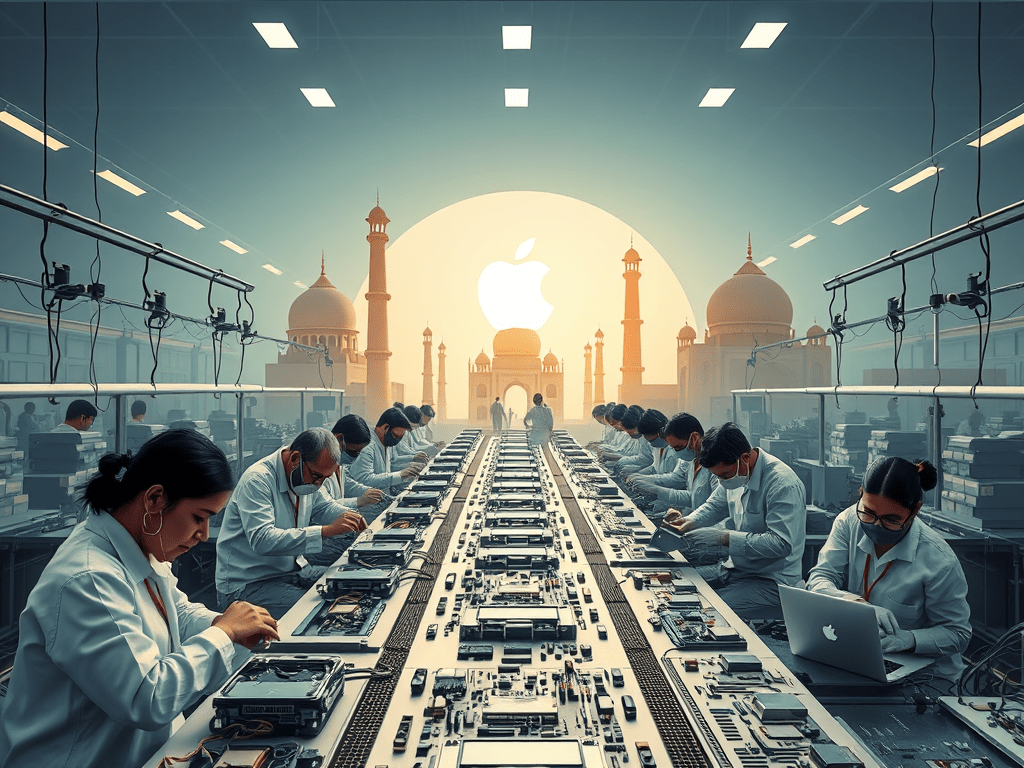

Apple has rapidly scaled up its operations in India, making the country a key hub in its global supply chain. Driven by geopolitical shifts, government incentives, and a growing domestic ecosystem, Apple’s strategy highlights India’s rising role in global electronics manufacturing.

Key Data on Apple’s Expansion in India

| Aspect | Details |

|---|---|

| Supply Chain Expansion | ~45 companies now part of Apple’s Indian supply chain. |

| Job Creation | ~350,000 jobs created (120,000 direct). |

| iPhone Production | 1 in 5 iPhones is manufactured in India. |

| Geopolitical Factors | Shift away from dependence on China due to India–China tensions. |

| Government Incentives | Production-Linked Incentive (PLI) scheme encouraging local manufacturing. |

| Ecosystem Diversity | Includes large Indian firms and 20+ MSMEs. |

| Domestic Value Addition (DVA) | India: 19% vs. China: 40–45%. |

| Export Growth (2021–2025) | $45 billion worth of iPhones produced in India; 76% exported. |

| Long-Term Potential | Analysts project India’s role in iPhone production will expand as the ecosystem matures. |

| Investment Climate | Influx of Indian firms signals robust growth in India’s electronics sector. |

Major Drivers of Apple’s Strategy

1. Strengthening the Supply Chain

Apple has onboarded nearly 45 companies into its Indian supply chain, creating a more resilient and diversified network. This shift reduces dependence on Chinese suppliers amid growing geopolitical uncertainties.

2. Boosting Employment

The expansion has generated approximately 350,000 jobs, including 120,000 direct jobs, giving a strong push to India’s electronics manufacturing workforce.

3. iPhone Manufacturing Shift

India now produces 20% of global iPhone output, underscoring Apple’s confidence in India’s growing capabilities.

4. Government Support

India’s PLI scheme has been instrumental in encouraging both local firms and foreign suppliers to scale up investments in electronics and component manufacturing.

5. Ecosystem Development

Apple’s Indian ecosystem is diverse, involving large companies as well as over 20 MSMEs, fostering innovation and supply chain depth.

6. Domestic Value Addition

While India’s DVA (19%) is still below China’s (40–45%), continuous investments and ecosystem strengthening are expected to bridge this gap over time.

7. Exports and Global Impact

From 2021–2025, iPhones worth $45 billion were produced in India, with 76% exported, showcasing India as not just a domestic manufacturing base but also a global export hub.

Companies in Apple’s Indian Supply Chain

Apple’s local supply chain includes a mix of large enterprises and MSMEs, such as:

- Tata Electronics

- Aequs

- Jabil

- Microplastics

- ATL

- Salcomp

- Foxlink

- Motherson

- Bharat Forge

- Wipro PARI

- Hindalco

- Avary

- SFO Technologies

- Titan Engineering & Automation Ltd

- VVDN

Outlook

Apple’s deepening footprint in India signals a long-term growth trajectory for the country’s electronics sector. With rising investments, robust government support, and the growing participation of local firms, India is steadily positioning itself as a global manufacturing and export hub for Apple products.

Leave a comment