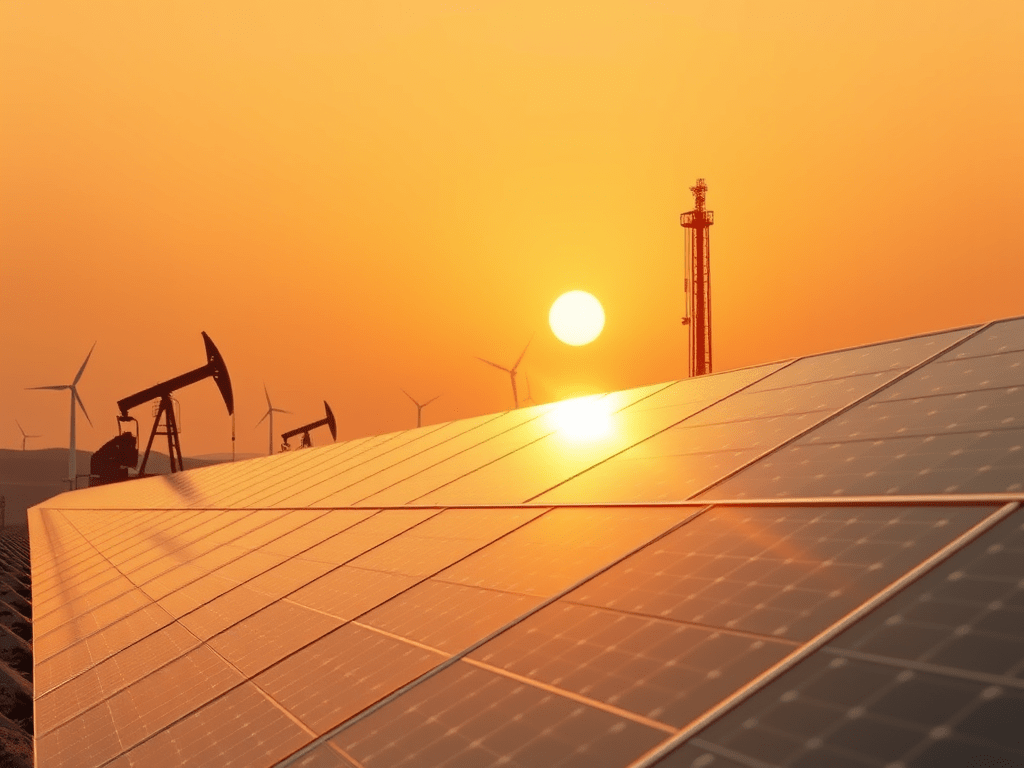

Saudi Arabia, the world’s largest crude oil exporter, is undergoing a significant energy transition that could reshape both its domestic energy landscape and the global oil market. Long reliant on crude oil to power its electricity generation, the kingdom is now pushing aggressively towards renewable energy under its Vision 2030 strategy.

Oil Consumption Trends

Since the early 2000s, Saudi Arabia’s domestic oil consumption has doubled to approximately 2.3 million barrels per day (bpd), with much of this directed toward electricity generation. This high level of domestic consumption has traditionally reduced the amount of oil available for export.

Vision 2030 and Renewable Energy Push

To address this, the government has launched a renewable energy expansion plan that targets a 130 gigawatt (GW) renewable capacity by 2030, combining solar and wind projects with natural gas. This would not only diversify Saudi Arabia’s energy mix but also drastically reduce its reliance on oil for power generation.

Implications for Oil Exports and Global Markets

A successful transition would free up significant volumes of oil for export, which could increase supply in global markets and potentially contribute to lower prices. While skepticism remains about Saudi Arabia’s ability to meet its ambitious renewable targets—given past delays—recent progress, especially in solar projects spearheaded by ACWA Power, indicates growing momentum.

Economic Viability of Renewables

One of the strongest drivers of this shift is cost efficiency. Solar power projects in Saudi Arabia are now producing electricity at prices lower than fossil fuels, making renewables not only environmentally sustainable but also economically compelling.

Key Data Summary

| Factor | Key Finding |

|---|---|

| Domestic Oil Consumption | ~2.3 million bpd (doubled since early 2000s) |

| Primary Use of Oil | Electricity generation |

| Vision 2030 Target | Transition to gas-renewables energy mix |

| Planned Renewable Capacity | 130 GW by 2030 |

| Export Implications | More oil freed for global exports |

| Market Impact | Risk of global oversupply if exports rise |

| Cost of Renewables | Solar energy costs lower than fossil fuel-based electricity |

| Challenges | Skepticism over past unmet targets, though recent solar progress shows promise |

| Key Players | ACWA Power and other renewable developers |

Broader Outlook

Saudi Arabia’s shift from being one of the largest domestic oil consumers to a potential exporter of surplus crude could have far-reaching implications. If successful, this move could:

- Strengthen Saudi Arabia’s export revenue streams.

- Contribute to lower global oil prices by adding supply to the market.

- Position Saudi Arabia as a leader not just in fossil fuels but also in renewable energy innovation.

This transition, while ambitious, highlights a paradigm shift in global energy—where even the world’s oil giants are embracing renewables as a central pillar of future economic growth.

Leave a comment