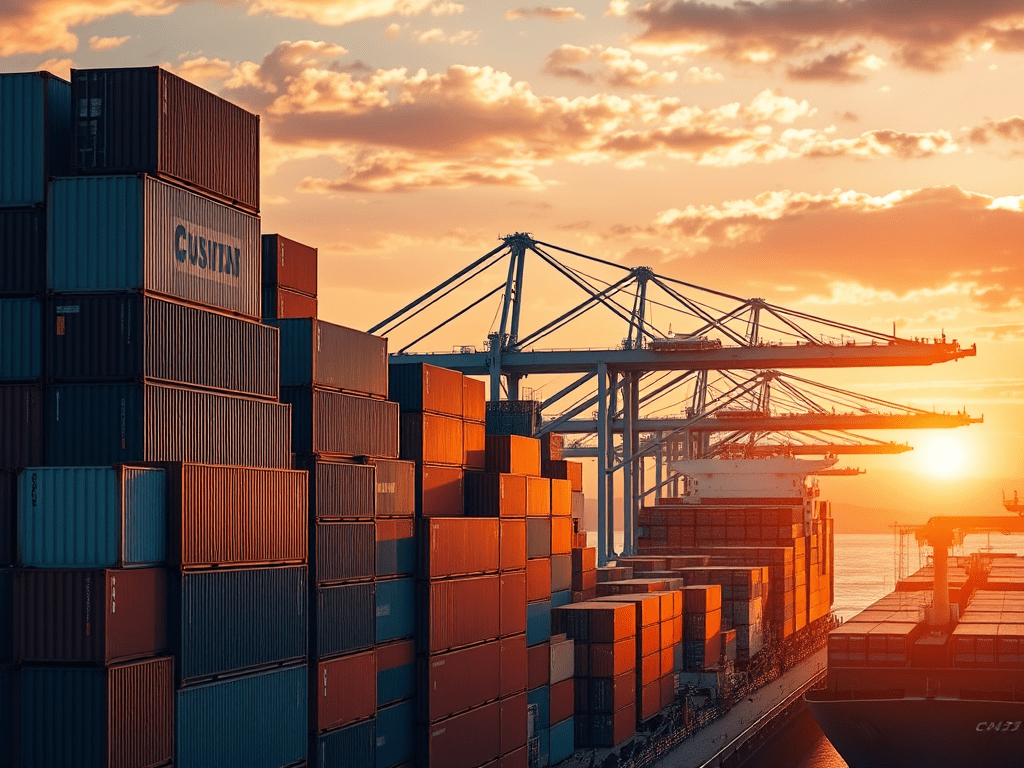

The shipping and logistics sector continues to experience dynamic shifts as global trade responds to economic pressures, geopolitical tensions, and seasonal trends. From falling container rates to tariff uncertainties, industry stakeholders are preparing for a volatile end to the year.

Key Market Highlights

| Factor | Current Update | Impact/Trend |

|---|---|---|

| Fall Flash Sale | $600 off F3 admission (valid until October 3) | Boosts participation in F3: Future of Freight Festival |

| Container Rates | Eastbound trans-Pacific rates declining | Weak demand expected to push rates further down |

| Inbound Ocean TEUs Volume Index | Down 14.58% YoY (as of Oct 1), weekly decline <1% | Reflects weaker import demand |

| China’s Golden Week | Minor demand increase from frontloading | Not enough to offset falling rates |

| U.S.-China Tariffs | Current ~55%; could rise to 145% (China goods) and 125% (U.S. goods) by Nov 14 if no agreement | Potential disruption to global trade |

| Asia–U.S. West Coast Rates | Fell 15% to $1,853/FEU | Indicates softer demand |

| Asia–U.S. East Coast Rates | Rose 16% to $3,967/FEU | Stronger demand versus West Coast |

| Sailing Cancellations | ~13% of scheduled sailings canceled | Lower than 2023 Golden Week reductions |

| Upcoming Event | F3: Future of Freight Festival, Oct 21–22 | Networking and insights with industry leaders |

Understanding TEU Volume Shifts

The TEU Volume Index, a crucial indicator of global shipping activity, is being shaped by several intertwined factors:

- Demand Fluctuations

- Seasonal peaks (e.g., Golden Week, holiday shopping) temporarily boost volumes.

- Long-term market shifts in consumer spending drive sustained changes.

- Economic Conditions

- Global recessions reduce imports, while strong economies increase demand.

- Consumer confidence directly impacts trade volumes.

- Supply Chain Dynamics

- Port efficiency, container availability, and vessel deployment influence capacity.

- Sailing cancellations adjust supply to balance weak demand.

- Tariffs & Trade Policies

- Rising tariffs between the U.S. and China risk reducing trade flows.

- Trade deals can stabilize or accelerate shipping demand.

- Market Competition

- Lower freight rates can attract more volume, while high costs deter shipments.

- Carrier strategies, such as blank sailings, help manage rate volatility.

- Geopolitical Factors

- Tensions and sanctions alter global trade lanes.

- Regulatory changes reshape compliance costs and timelines.

- Environmental Pressures

- Sustainability goals are reshaping fleet operations and fuel use.

- Technological Advances

- Real-time tracking, digital booking, and AI-driven optimization improve efficiency and potentially stabilize volumes.

Looking Ahead

With tariffs looming, container rates fluctuating, and TEU volumes declining, the industry is bracing for an uncertain close to 2025. The upcoming F3: Future of Freight Festival (Oct 21–22) will serve as a critical platform for stakeholders to explore strategies for resilience and growth in this evolving landscape.

Leave a comment